From having a humongous loan portfolio of N192 billion in 2012 via his then Zenon Petroleum and Gas Ltd which was eventually passed on to the Asse

From having a humongous loan portfolio of N192 billion in 2012 via his then Zenon Petroleum and Gas Ltd which was eventually passed on to the Asset Management Company of Nigeria, billionaire businessman, Femi Otedola has today taken over First Bank of Nigeria Plc with his recent acquisition of about N30 billion worth of shares, making him the single largest shareholder of the bank, The Street Journal is reporting.

What this invariably means is that being the largest shareholder, he holds the highest voting shares and can dictate the direction of the bank through his voting power.

In 2019 when he divested his 75% direct and indirect share holding in Forte Oil, via a merger of his company Zenon Oil and former African Petroleum, many wondered why he made such a decision especially because of the lucrative nature of the oil and gas sector.

They became all the more curious as to what his next move would be. He didn’t keep them guessing too long as he soon announced that he wanted to explore and maximize business opportunities in refining and petrochemicals.

Even though he also had investments in the real estate and financial sector, Otedola singled out First Bank for the single reason that there wasn’t exactly one man calling the shots there, unlike in other new generation banks.

He wasted no time in taking advantage of the leadership crisis that rocked First Bank not too long ago that the Central Bank of Nigeria sacking both the chairman of the bank, Ibukun Awosika and Obafemi Otudeko, the chairman of FBN Holdings.

Otedola made his moves and today, he is better for it.

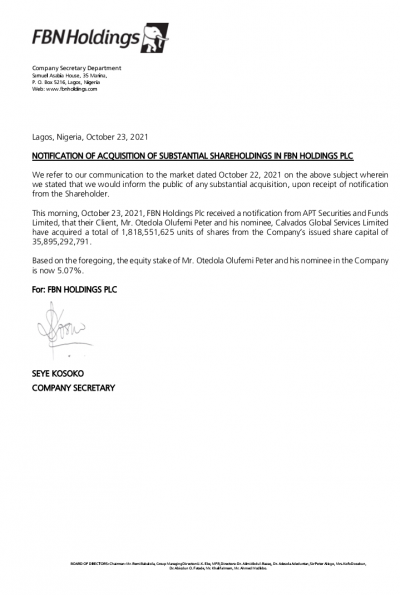

See letter below from FBN Holdings acknowledging his recent acquisition