The Nigerian government is in huge financial trouble, the governor of Edo State, Godwin Obaseki has said. Mr. Obaseki who spoke at a programme in t

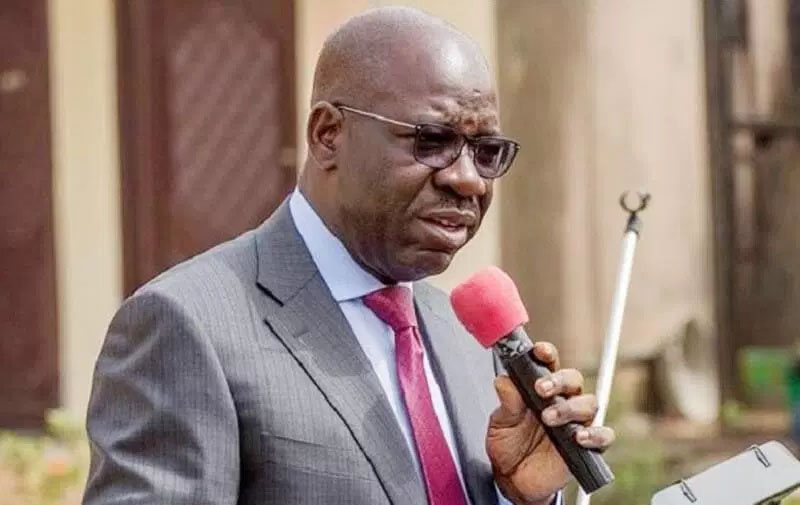

The Nigerian government is in huge financial trouble, the governor of Edo State, Godwin Obaseki has said.

Mr. Obaseki who spoke at a programme in the state on Thursday said the federal allocation for March was insufficient, forcing the federal government to print between N50 billion and N60 billion for states to share.

Obaseki said:

“When we got FAAC for March, the federal government printed additional N50-N60 billion to top-up for us to share.

“This April, we will go to Abuja and share. By the end of this year, our total borrowings is going to be within N15-N16 trillion. Imagine a family that is just borrowing without any means to pay back and nobody is looking at that, everybody is looking at 2023, everybody is blaming Mr. President as if he is a magician.”

Obaseki said the rising debt profile is worrisome. He attributed this to overdependence on crude oil. He noted that as oil companies in the country were shutting down, it is high time the federal government came up with other sources of revenue.

“Nigeria has changed. The economy of Nigeria is not the same again whether we like it or not. Since the civil war, we have been managing, saying money is not our problem as long as we are pumping crude oil every day.

“So we have run a very strange economy and a strange presidential system where the local, state and federal government, at the end of the month, go and earn salary. We are the only country in the world that does that.

“Everywhere else, government rely on the people to produce taxes and that is what they use to run the local government, state and the federation.

“But with the way we run Nigeria, the country can go to sleep. At the end of the month, we just go to Abuja, collect money and we come back to spend. We are in trouble, huge financial trouble.

“The current price of crude oil is only a mirage. The major oil companies who are the ones producing are no longer investing much in oil. Shell is pulling out of Nigeria and Chevron is now one of the world’s largest investors in alternative fuel, so in another year or so, where will we find this money that we go to share in Abuja?” Obaseki asked.