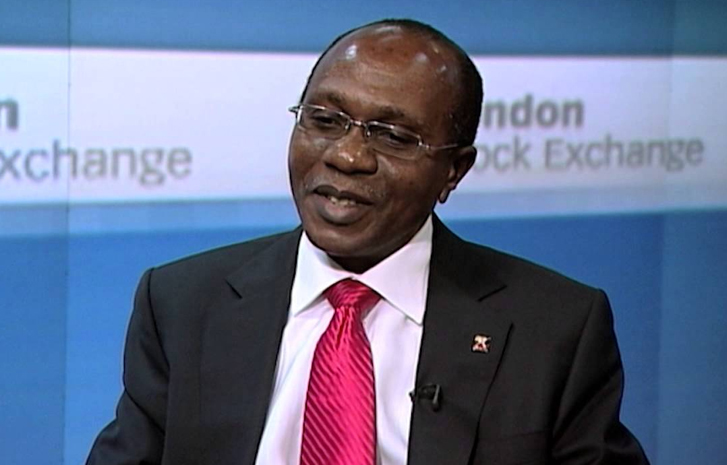

The Special Investigator on the Central Bank of Nigeria, CBN, and Related Entities, Jim Obaze has revealed that the former Governor of the apex bank,

The Special Investigator on the Central Bank of Nigeria, CBN, and Related Entities, Jim Obaze has revealed that the former Governor of the apex bank, Godwin Emefiele, illegally lodged billions of naira in no fewer than 593 bank accounts in the United States, United Kingdom, and China.

This, he said, Emefiele did without the approval of the apex bank’s board of directors and the CBN Investment Committee.

Obaze found that the former CBN governor lodged £543,482,213 in fixed deposits in UK banks alone without authorization.

The Special investigator appointed by President Tinubu submitted his final report tagged, ‘Report of the Special Investigation on CBN and Related Entities (Chargeable offences) to the President on Wednesday, December 20.

The report partly read, “The former governor of CBN, Godwin Emefiele invested Nigeria’s money without authorization in 593 foreign bank accounts in United States, China and United Kingdom, while he was in charge.

“All the accounts where the billions were lodged have all been traced by the investigator.”

In a letter dated July 28, 2023, President Tinubu had named a former Executive Secretary of the Financial Reporting Council of Nigeria, Obazee, as the CBN special investigator.

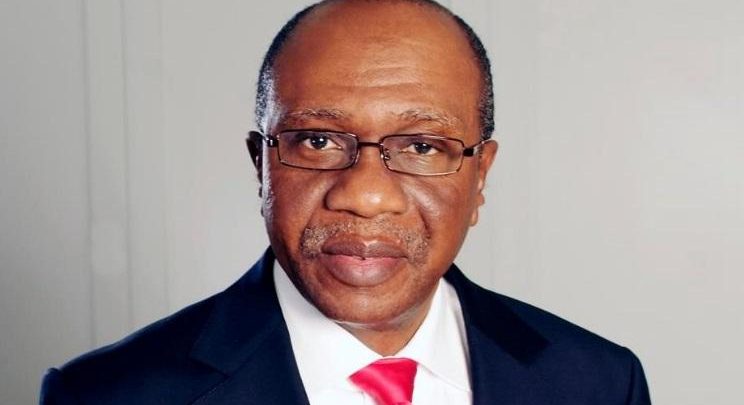

Emefiele, who is currently in Kuje Custodial Centre, Abuja, is being prosecuted for N1.2 billion procurement fraud.

The former CBN Governor has not been able to perfect the N300 million bail granted him by a High Court of the Federal Capital Territory, Abuja, on November 22, 2023.

He is likely possible to face fresh criminal charges over the handling of the CBN naira redesign policy.

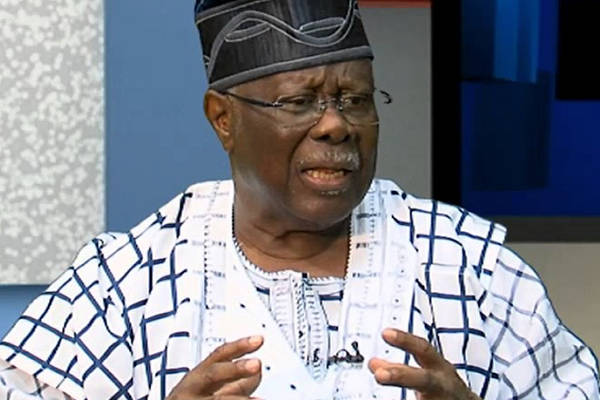

Emefiele could be prosecuted for illegal issuance of currency under section 19 of the CBN Act alongside Tunde Sabiu, a former aide to former President Muhammadu Buhari, and 12 top directors of the CBN.

It was learned that the naira redesign policy was sold to Buhari at the instance of Sabiu and that the initiative was done without the approval of the board of the CBN.

The investigator found that Buhari didn’t approve of the naira redesign. It was Tunde Sabiu who first told Emefiele in September 2022 to consider the redesign of the naira. On October 6, 2022, Emefiele wrote to Buhari that he wanted to redesign and reconfigure N1000, N500 and N200 notes.

“The former President tagged along but did not approve the redesign as required by law. Buhari merely approved that the currency be printed in Nigeria. The redesign was only mentioned to the board of the CBN on December 15, 2022, after Emefiele had awarded the contract to the Nigerian Security Printing and Minting Plc on October 31, 2022,’’ the documents noted.

Emefiele was said to have contracted the redesign of the naira to De La Rue of the UK for £205, 000 pounds under the vote head of the Currency Operations Department after the NSPM said it could not deliver the contract within a short timeframe.

The special investigator found that N61.5 billion was earmarked for the printing of the new notes out of which N31.79 billion had been paid.

As of August 9, 2023, findings revealed that N769 billion of the new notes were in circulation.

The probe of the CBN also revealed the fraudulent use of N26.627 trillion Ways and Means of the Apex Bank as well as the misuse of the COVID-19 intervention fund.

For instance, the CBN under Emefiele at its 661st meeting held on October 27, 2020, approved that the Consolidated Revenue Fund Account should be debited with the sum of N124.860 billion, and the decision was implemented on October 9.

Similarly, the Committee of Governors at its 670th meeting held on December 9, 2020, granted anticipatory approval pending receipt of a formal request by then President Buhari and ratification by the board of directors the payment of the sum of N250 billion only to the Federal Government of Nigeria to address challenges as a result of low revenue inflow and the payment of salaries.

The decision was implemented on December 15, 2020.

Also on December 30, 2020, the committee of governors at its 672nd meeting granted another anticipatory approval for N250 billion to the Federal Government for payment of salaries pending receipt of a formal request by Buhari and ratification by the board of directors.

The apex bank’s management through the Finance and General Purpose Committee equally granted anticipatory approval on the investment of $200 million in equity warrants of the Africa Finance Corporation.

The CBN investigator discovered that the CBN Ways and Means was abused under the Buhari administration.

The document further said, “In an instance, they (senior CBN and government officials) padded what the former President Muhammadu Buhari approved with N198.9 billion. There are instances where no approvals are received from the former president and yet, N500 billion is taken and debited to Ways and Means.

“There are more shocking instances where the erstwhile CBN governor and his four deputy governors connived to steal outright in order to balance the books of the CBN.

“This was by violently taking money from the Consolidated Revenue account and then charging it to Ways and Means. It was a total of N124.860 billion. They even created the narration as a presidential subsidy and expanded the ways and Means portfolio to accommodate crime.

“The CBN officers and even the then acting CBN governor could not produce the Presidential Approval of most of the expenses described as ‘Ways and Means.’ When confronted, to provide the breakdown of the supposed N22.7 trillion that was presented to the 9th National Assembly to illegally securitise as ‘Ways and Means’ financing, they were only able to partially explain a total of N9.063 trillion or N9.2 trillion depending on which official you are considering his submission and an unreasonable attribution of non-negotiated interest element of N6.5 trillion.

“This shows that this was the point where the officers of the immediate past administration as well as the erstwhile CBN governor and his four deputy governors connived, defrauded, and stole from the commonwealth of our country with the aid of civil servants.’’

Continuing, the report said, “The true position of the Ways and Means as documented from the reconciliation between the CBN and the Ministry of Finance at the time is N4.45 trillion.

“This may have been the main reason the past administration hurriedly sought that the advances of N22.7 trillion be securitised by the 9th National Assembly on December 19, 2022, which they also hurriedly did despite the fact that it contravenes section 38 of the CBN Act, 2007.”

The CBN under Emefiele was also said to have spent N1.7 billion on questionable legal fees for 19 cases instituted against the naira redesign policy.

The investigator also discovered how Emefiele misrepresented the presidential approval for the NESI Stabilisation Strategy Limited approved by former president Goodluck Jonathan.

The document read, “The Presidential approval granted by then President Goodluck Jonathan was rightly stated by him NESI should be a company limited by guarantee but the Committee of Governors misled the Board of the CBN by relying on non-existent advice by the office of Attorney-General and Minister of Justice to incorporate a company limited by shares for which the allotted share capital exceeded the authorised share capital (See 380th meeting of the Committee of Governors held in January in January 2015) and allotting unauthorised share capital to Mr Godwin Emefiele and Mr Mudashiru Olaitan without lawful approval by the President.

“N1.325 billion was stolen pre-incorporation and the money funnelled to four companies, including a legal firm which got N300mn.’’

A breakdown indicated that the firm received N262 million in 2015, N464 million in 2016, N550 million in 2017, N726 million in 2018, N762 million in 2019, N684 million in 2020 and N1.44 billion in 2021, totalling N4.89 billion.