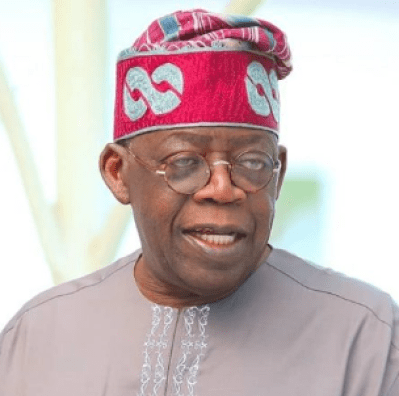

In his Independence Day speech, one of the things President Bola Ahmed Tinubu said among others is that his administration has cleared the N30 trillio

In his Independence Day speech, one of the things President Bola Ahmed Tinubu said among others is that his administration has cleared the N30 trillion Ways and Means debt it inherited from the previous administration.

He said that his administration had cleared the debt and reduced the debt service ratio from 97% to 68% while maintaining the country’s foreign reserves at $37 billion.

“We have cleared the ways and means debt of over N30 trillion. We have reduced the debt service ratio from 97% to 68%. Despite all these, we have managed to keep our foreign reserve at $37 billion. We continue to meet all our obligations and pay our bills,” the Tinubu said.

The discussions around ways and means, debt, and revenue have been a hot topic in Nigeria, especially since the previous administration. During the transition from Muhammadu Buhari to Tinubu, the exact figures and usage of the ways and means advances became controversial.

Under Buhari, the ways and means debt grew from N856 billion to N23.7 trillion. This was according to the official records.

However, a report by the Joint Senate Committee on Banking, Insurance and Other Financial Institutions, Finance, National Planning, Agriculture and Appropriation cast doubts on the exact amount and usage of the ways and means. The report showed that N30 trillion, borrowed from the Central Bank of Nigeria (CBN) by the Buhari administration, could not be accounted for.

So what really happened to the debt?

In December 2023, the National Assembly approved Tinubu’s request to securitise N7.3 trillion of outstanding ways and means debt. The N7.3 trillion was the interest that had piled up on a N23 trillion debt owed to the CBN, according to Godswill Akpabio, the senate president.

Before Tinubu, Buhari had also tried to securitise the N23.7 trillion ways and means debt. He presented the request to the National Assembly in December 2022. The National Assembly approved Buhari’s request about six months later in May.

But what exactly does this mean?

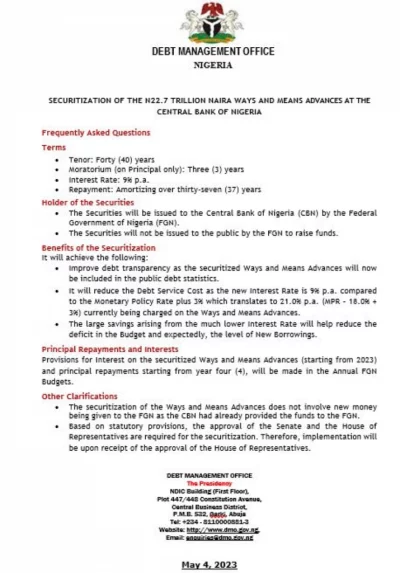

In May 2023, the Debt Management Office (DMO) gazetted what the securitisation would mean for the Federal Government. According to the DMO, the loan will be restructured to span over 40 years. In the first three years of repayment, the FG has a moratorium. This means that they would not have to repay the principal amount to the CBN.

The FG would however have to repay the interest within these three years at 9% per annum instead of the original 21%.

After the three years of grace, the debt will be gradually repaid over 37 years. That way, Nigeria can repay the loan under relatively lax conditions, without burning through capital.

Essentially, the loan would be converted into bonds and would be issued to the CBN. This extends the repayment time and reduces the interest rate by a considerable percentage.

According to the DMO, the securities would be issued exclusively to the CBN instead of to the general public. As a result, only the CBN has to bear the risks if the FG does not meet its loan obligation. The outstanding N7.3 trillion was also securitised in the same manner as the N23.7 trillion.

The ways and means is an overdraft the CBN issues to the FG to finance shortfalls in its budget. Essentially, it is short-term, moderate interest and supposed to cater to emergency spending of the government.

Section 38 (2) of the CBN Act however moderates how much ’emergency funding’, the government can get from the CBN. It says that “the total amount of such advances outstanding shall not at any time exceed five per cent of the previous year’s actual revenue of the Federal Government”.

However, between 2017 and 2022, Buhari and the CBN consistently ignored the borrowing cap stipulated by law. In 2017, Buhari borrowed ways and means to the tune of N2.7 trillion, according to a Dataphyte Report. This amount exceeded the actual revenue by 37.2% at the time.

By 2019, ways and means stood at N3.3 trillion. The percentages were also as unfriendly; the debt was already 85% higher than the actual revenue at the time. By the end of 2022, the ways and means shot up to 138% of the 2021 revenue.

The spillover effect of this is what the Tinubu administration has been struggling to deal with.

Patience Oniha, the Director General of the DMO, recently said that the DMO had secured N4.9 trillion out of the N7.3 trillion securitised outstanding loan. She disclosed this in May while addressing dealers in FG securities.

It is misleading to claim that the N30 trillion ways and means debt, which was adjusted, has been cleared. There is no evidence to show the government has fully repaid the whole amount. Nigeria is not free from the ways and means debt; FG is only obligated to repay it at a reasonable pace.