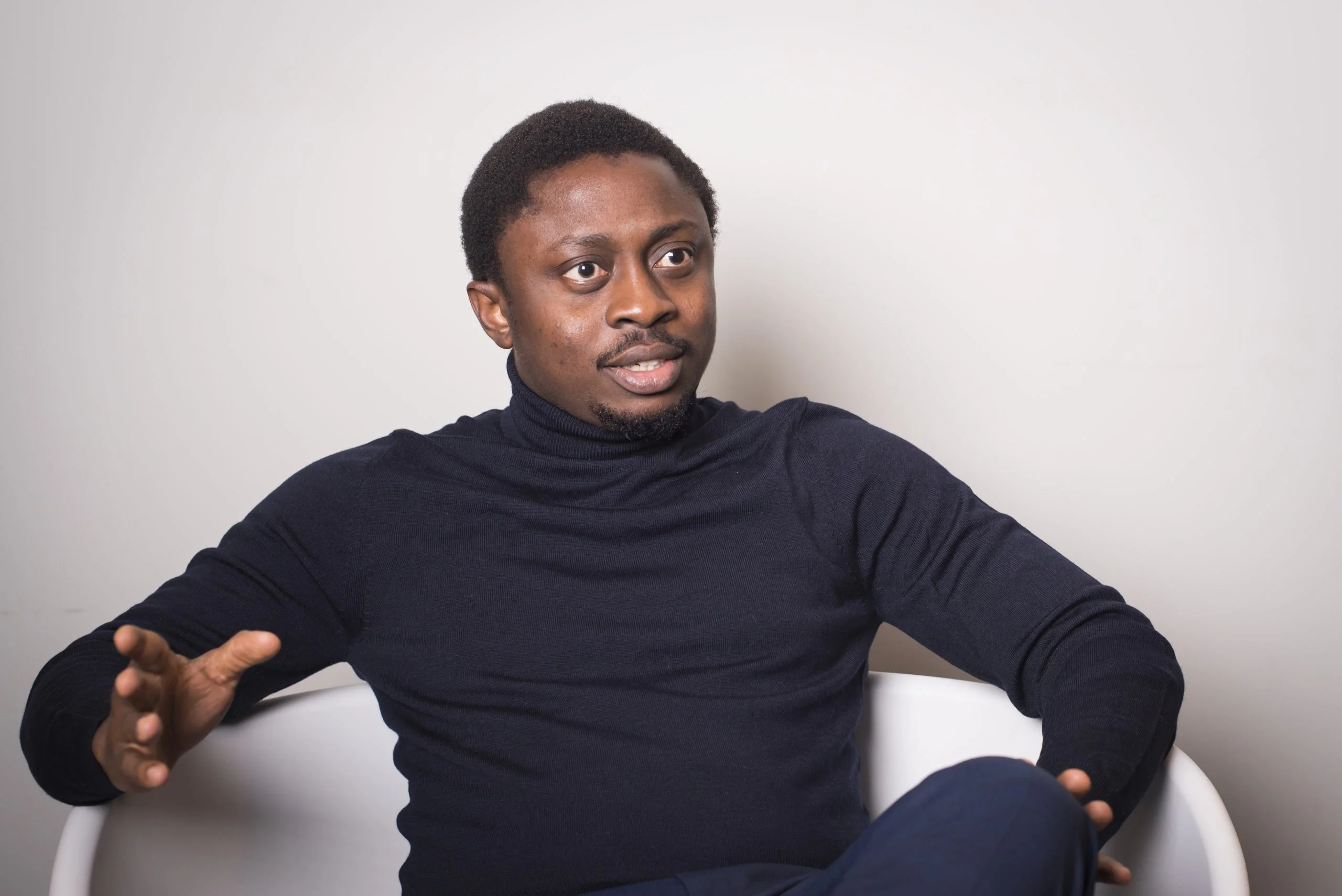

Ibrahim Ibitade, the CEO of Leatherback, a fintech startup that provides cross-border payments to customers in seven countries, has said he is not hid

Ibrahim Ibitade, the CEO of Leatherback, a fintech startup that provides cross-border payments to customers in seven countries, has said he is not hiding after Nigeria’s Economic and Financial Crimes Commission, EFCC declared him wanted.

According to an Instagram post from the commission, 31-year-old Ibitade is wanted in connection with allegations of conspiracy and obtaining money under pretense.

A source at the EFCC, a law enforcement agency that investigates financial crime, confirmed the authenticity of the notice but did not provide further details.

“Since this investigation began, Leatherback has supported the EFCC with multiple resources and documentary evidence that has aided this investigation,” said Ibrahim Ibitade.

“We have done as much as required to ensure the authorities have all the necessary information. My team has spent 35 of the last 60 days at the EFCC offices in Lagos and Abuja. We are not hiding from the EFCC.”

Sources with direct knowledge of the matter said that the EFCC is investigating fraud involving a company called SDQ Financials. According to the Corporate Affairs Commission website, SDQ Financials is incorporated in Nigeria, and only one individual, Lawal Mohammed Kazeem, is listed as having significant control of the company.

However, six people with knowledge of the matter said SDQ Financials, a merchant on Leatherback, promised several companies and individuals better FX rates than what was obtainable on Nigeria’s black market. Those sources said several prominent companies, including a publicly listed company, gave billions of Naira to SDQ Financials, an unregulated entity with very little publicly available information, for FX deals. Sources described deals similar to those done by Float, a company that lost at least ₦5 billion in customer deposits.

According to Leatherback, SDQ Financials is a merchant that uses Leatherback’s Naira and USD wallets. The company said it completed a Know Your Customer (KYC) onboarding process for SDQ Financials and kept records of its transactions, as mandated by law. It denies any direct involvement with SDQ Financials and says it did not know about the fraud allegedly perpetrated by SDQ Financials.

EFCC began investigating Leatherback because some of the Naira funds reportedly received by SDQ Financials were traced to Leatherback’s wallets. It is unclear how much the EFCC is trying to actively recover, but two sources say at least ₦3 billion remains unaccounted for.

The EFCC has not shared any information on the specifics of its investigation.

Nonetheless, Leatherback says it is unfazed and believes it is being bullied.

“If a commercial bank in Nigeria issues an account to an individual or a business and that business goes to defraud other people, will you declare the CEO of the commercial bank wanted?” Ibitade asked.