Following the Economic and Financial Crimes Commission (EFCC) reopening of the investigation into the alleged N100 billion case of fraud involving for

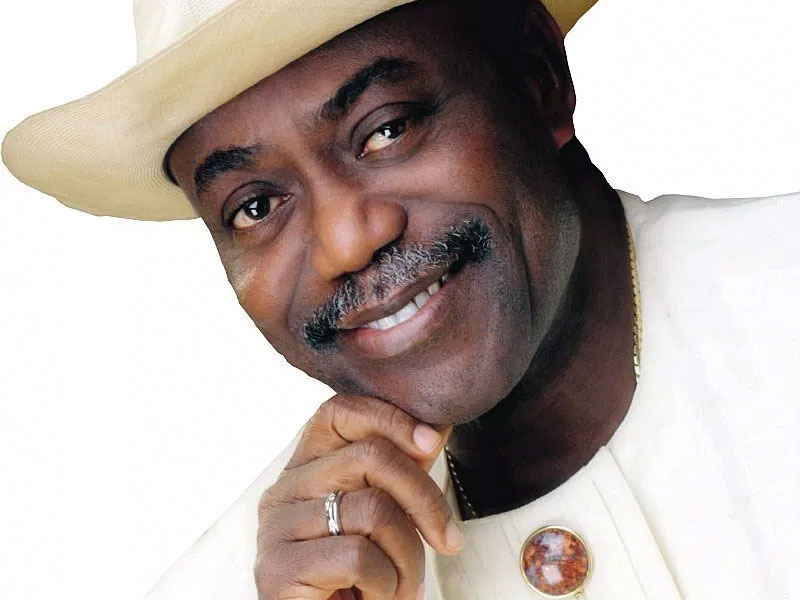

Following the Economic and Financial Crimes Commission (EFCC) reopening of the investigation into the alleged N100 billion case of fraud involving former Rivers State governor, Dr Peter Odili, he has subsequently sued the anti-graft-agency, Leadership Newspaper is reporting.

In the suit, which comes on March 30, 2020, the former governor is asking that the 2007 restriction order on the commission to be maintained.

In 2007, some restraining orders were obtained by both the representative of the state government and Odili when the investigation began in 2006. It was aborted by some high courts based on a suit instituted by Odili and officials of the state govt.

The petitioner had alleged that Odili, as governor conspired with officials of his government and the chairman of Rocksons Engineering Group of Companies to divert over N100 billion from the accounts of Rivers State, alleging that he used same for power projects in Rivers.

The petitioner also went further to say that part of the state fund was moved to the Government House account, from where it was distributed to the then governor and his relatives and investigation commence.

The account of the Government House domiciled in Zenith Bank was immediately obtained and the details revealed that between 2004 and 2006, about N4 billion was moved in cash to Zenith Bank branch in Maitama in favour Odili’s aide-de-camp (ADC), Isaac Onyesom and one Emmanuel Nkata, who was a member of staff in River State Liaison Office, Abuja.

The funds were allegedly withdrawn as cash for Odili. EFCC sources stated that Nkatah was arrested and he confirmed that the funds were withdrawn for the former governor through his ADC. Investigation was on when the ADC, an assistant superintendent of police (ASP), suddenly retired from the police and disappeared into thin air. The ADC, the principal suspect in the alleged fraud have since been in hiding, refusing to honour the invitation of the commission.

According to the sources, among those who benefited from the funds was a former chairman of the Peoples Democratic Party (PDP), who received a manager’s cheque of N100 million from the same account on November 28, 2005. Between 2005 and 2006, Odili allegedly paid a certain professor about N1.5 billion which was used to obtain a doctorate degree and naming of a hall after Odili in Lincoln University, USA and many others.

From the same account, he allegedly moved N3 billion to an oil company for shares, N1.4 billion to a bottle water company, and about N1.8 billion to a communication company which as of 2006, had no share as it was not a quoted company.

The EFCC noted that when the investigation commenced, Odili involved the state government to take over the shares but the state government was not comfortable and requested that the companies return its money. While investigation was going on to unravel the remaining beneficiaries and the funds that were moved to Rockson Group of Company, these and others made Peter Odili to approach the court where he obtained a perpetual order so that the investigation be stopped.

The EFCC sources, however, noted that new intelligence had emerged against the third party which had link with some group of companes belonging to Odili.

“Sometime in 2018, information was received that some companies belonging to a retired ASP: NUMAC Project Company Ltd and NUMAC Global Resources Ltd, had between 2004 and 2018 received over N5 billion into the account and the funds came in tranches of N500, N300 millions among others, which is suspicious.

“The intelligence further explained that the funds are in the following accounts: GTB, Zenith, FBN, Access, Standard Chartered, FCMB and UBA. Turnover in all the accounts are believed to be over N10 billion. These companies and their accounts were thoroughly investigated and it was discovered that the inflow into these accounts are mostly cash. On few occasions, about N2 billion came in from River State government account before 2016 and 2017.

“These funds were traced to the following Companies: Pamo Group of companies Ltd, Pamo Clinic and Hospital and Pamo Educational Foundation. The above companies were found to have belonged to Dr. Peter Odili and his family. Based on the above, and in view that the above companies were not part of restraining order of the Federal High Court, the EFCC commenced further investigation. It was further established that the funds were moved from the Banks in Abuja contrary to the cairns that the money formed part of security.”